Medical Practice Accountant H&M

Content

- Financial Documents You Need for Proper Medical Accounting

- Health Care Accounting Software: Does My Practice Need Better Medical Accounting?

- Adjustments in Chart of Accounts

- Accounting for Medical Practices

- Revenue Expenditure

- White Label Bookkeeping Services for Doctors

- Financial Controllership

- Review financial statements regularly

So it’s no surprise that bookkeeping falls to the bottom of your to-do list. Medical billing is a crucial part of running a successful medical practice, and it can have costly consequences if you don’t handle it correctly. When it comes to your bookkeeping, you want to ensure that everything is accurate and up-to-date. And if you’re starting your own medical practice, this can become a bit stressful.

Cash is routinely collected in a medical practice for co-pays, deductibles and the daily charges. A crafty staff member can adjudicate the patient account by posting a cash payment as a credit card payment and remove the cash. This method also creates false billing financial reports that are inflated because of the lack of an actual credit card payment. The billing account financial reports will show more income than the practice bank statements. Golden Apple Agency provides bookkeeping and accounting for medical practices, including physician-owned medical practices and medical groups.

Financial Documents You Need for Proper Medical Accounting

Put another way, whether or not a patient is satisfied with a particular healthcare provider can impact his or her treatment outcome. It can also be a deciding factor in whether to file a claim against the company if things don’t turn out as expected. If you’re not keeping accurate track of your monies coming in versus your monies going out, causing your gas or electric company to stop your service, patients aren’t going to be happy. But good bookkeeping and accounting practices offer another advantage as well. To make this concept easier to understand, imagine that you own a store that sells furniture. By default, then, you need to develop a way to create invoices for the items your customers want to purchase.

Let us handle your bookkeeping responsibilities so you can concentrate on giving your patients high-quality care and expanding your practise. Get in touch with us right away to find out more about our online bookkeeping services for doctors. Medical File Management – the management of patient records, accounting records, contracts and business-related documentation. Medical files can be in paper form or electronically stored in a computer database.

Health Care Accounting Software: Does My Practice Need Better Medical Accounting?

Here’s how to identify internal fraudsters’ schemes and apply remedies (even if you don’t work at a medical practice). Throughout this whole process, I kept strict financial records for both my personal and business spending. I continued to alter my pro forma accordingly, factoring in my spending and changes to actual costs from estimated costs. I know at all times where my budget accounting for medical practices lies, and what I need to spend and where I need to make cuts. In addition, keeping track of my business spending will help to maximize my deductions when I file my tax return. At the end of the month, I look at all of my credit card and bank statements, and compare the withdrawals to my report to make sure that all my expenses are reported, and that there’s no funny business.

When my clients ask me about financial advice or income tax preparation I always refer them to this company. They have put countless hours into helping people and are always willing to answer questions. For those who are on low income and doing their tax return the first time, Front Desk Helpers provide their service free of charge.

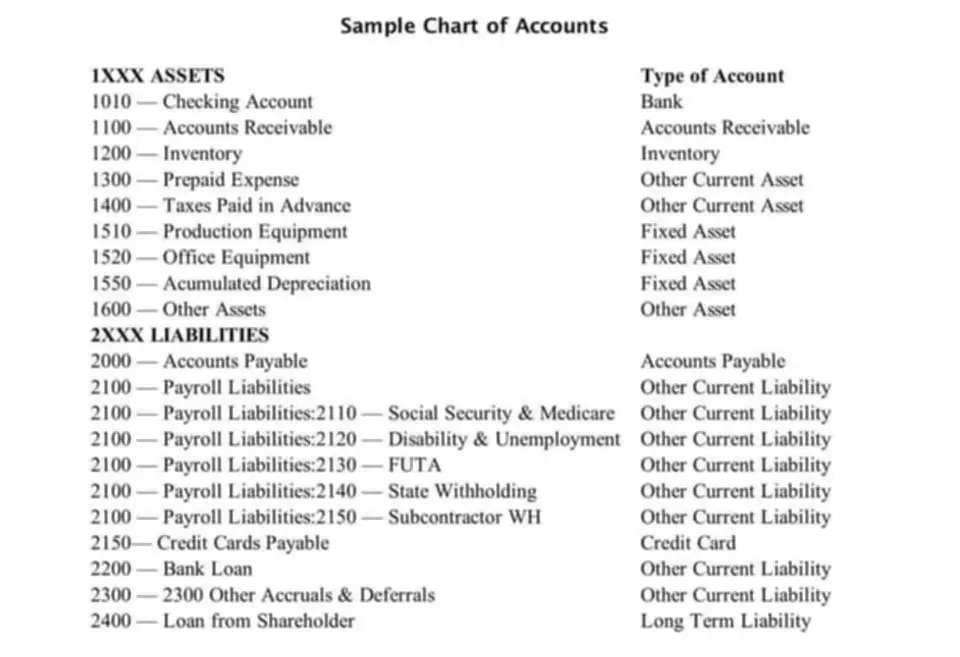

Adjustments in Chart of Accounts

Having the best medical practice management books possible is essential for managing your day-to-day transactions. However, this information can become much more valuable when you’re able to gain insights and additional information from it. For this method, it’s vital to prepare for large quarterly expenses, such as malpractice insurance.

- This type of posting can adjudicate the patient account and allows the staff member to remove the payment.

- The benefits of automation and reduced errors are invaluable to both the medical practices themselves and the patients they serve.

- A crafty staff member can adjudicate the patient account by posting a cash payment as a credit card payment and remove the cash.

- At the same time, an efficient accounts department can provide information to decision-makers who can then streamline operating procedures to ensure the financial success of the medical office.

- It’s about placing a health care facility in the best position possible to provide high-quality, difference-making patient care.

A medical practitioner faces many responsibilities and a lot of pressure. But, just as maintaining a patient’s health is important, it is also important to maintain the practice’s financial health. Ultimately, the success of the practice is as dependent on the successful management of its income as it is on the overall success of the medical practitioner, to heal and provide sound advice on all matters of health.

Accounting for Medical Practices

Giving our clients the financial support they need to succeed in their business is our only business. Copyright © 2008–2023 Scale Finance, LLCSecurities and offering services through Charles Towne Securities, LLC. If the staff sees doctors cheating their partners or doing things inappropriately, then the staff will be more likely to also cheat.

The first document to have ready is your most recent year-end balance sheet. A year-end balance sheet is a document that details a business’s assets, liabilities, and equity makeup at the end of a fiscal year. The document serves as a financial snapshot of your practice and is critical to the preliminary work of an accountant. The energy you expend now can lead to automated systems, better compliance and enhanced financial insight that will control costs, reduce risk and greatly simplify management in the years ahead. This story is part of a series on medical accounting written by Nicholas Turturro at MBSATA, the largest independent bookkeeping firm in New York City. The high cost of maintaining an accounting department can be prohibitive for many organizations.

Revenue Expenditure

Every type of organization needs an accounting department because it is impossible to continue working without one. While it may seem like a single part of a business, it is actually one of the main parts of any business. As a result, the accrual basis is much better at matching revenues with expenses and accurately representing your business’s financial situation. However, it makes cash flow monitoring harder, so remember to track that separately. Fortunately, modern cloud-based software solutions can automate many of the most time-consuming aspects.

What are the two types of bookkeeping?

The single-entry and double-entry bookkeeping systems are the two methods commonly used. While each has its own advantage and disadvantage, the business has to choose the one which is most suitable for their business.

Since bookkeeping and accounting practices are all part of the doctor-patient or provider-patient interaction, these practices can have an indirect impact on patient satisfaction levels. Another reason bookkeeping and accounting are important in healthcare is because the manner in which the facility is run can either positively or negatively impact patient satisfaction. When you’re ready to take some of those responsibilities off your plate, accounting and bookkeeping should be your top priority. Here are some common mistakes that arise when you don’t handle your medical accounting correctly.

Accrual accounting is a common form of bookkeeping in the medical industry. Through this method, you’ll account for all of your expenses the moment you receive a bill for them. On the same note, you’ll account for any receivables from your patients the moment you bill them rather than when they make a payment.